XRP has seen a 7% decline since Monday, coinciding with a pivotal week for the cryptocurrency market. The spotlight has been on David Sacks, President Donald Trump’s appointed “crypto czar,” who heralded this era as “a golden age in digital assets” during a recent press conference. His focus on establishing clearer regulations for stablecoins could significantly favor Ripple’s RLUSD.

The price of XRP is notably swayed by various factors, including the ongoing U.S. Securities & Exchange Commission (SEC) lawsuit against Ripple, the advancements in adoption and partnerships surrounding the RLUSD stablecoin, and the continuous development of the XRP Ledger (XRPL).

XRP could gain from Trump’s Crypto Czar’s first order of business

David Sacks has prioritized stablecoin legislation, as highlighted in his press conference this week. He aims to create a clearer regulatory framework that could permit broader innovations in the cryptocurrency sector. This focus on stablecoins is vital, especially for XRP holders, who could see favorable developments through lawmakers’ efforts in regulating this segment.

Following a steep decline, XRP’s value dropped from an opening price of $2.5801 on Monday to $2.4060. Sacks has given a timeline of six months for implementing stablecoin legislation, which could play a crucial role in XRP’s future prices as the crypto market stabilizes and matures.

Meanwhile, Ripple has been creating waves in the industry with the announcement of several partnerships for its RLUSD stablecoin. Now available on 14 different exchanges, including major platforms like Bitstamp, Revolut, and Uphold, the RLUSD can be utilized for trading and transactions across various financial applications.

Ripple lawsuit could end; CTO has optimistic outlook

The SEC’s lawsuit against Ripple, initiated in 2020, has engulfed XRP in a cloud of uncertainty. However, recent rulings from Judge Analisa Torres suggesting that secondary market sales of XRP may not be classified as securities could provide Ripple with leverage moving forward. Ripple’s legal team is optimistic, as these rulings have already translated into fluctuating XRP prices gaining traction in the market.

Ripple’s Chief Technology Officer has recently expressed hope that incoming regulatory changes will lead to more favorable conditions for the altcoin. His optimism reflects a sentiment that the cloudy regulatory landscape from past administrations might finally be shifting.

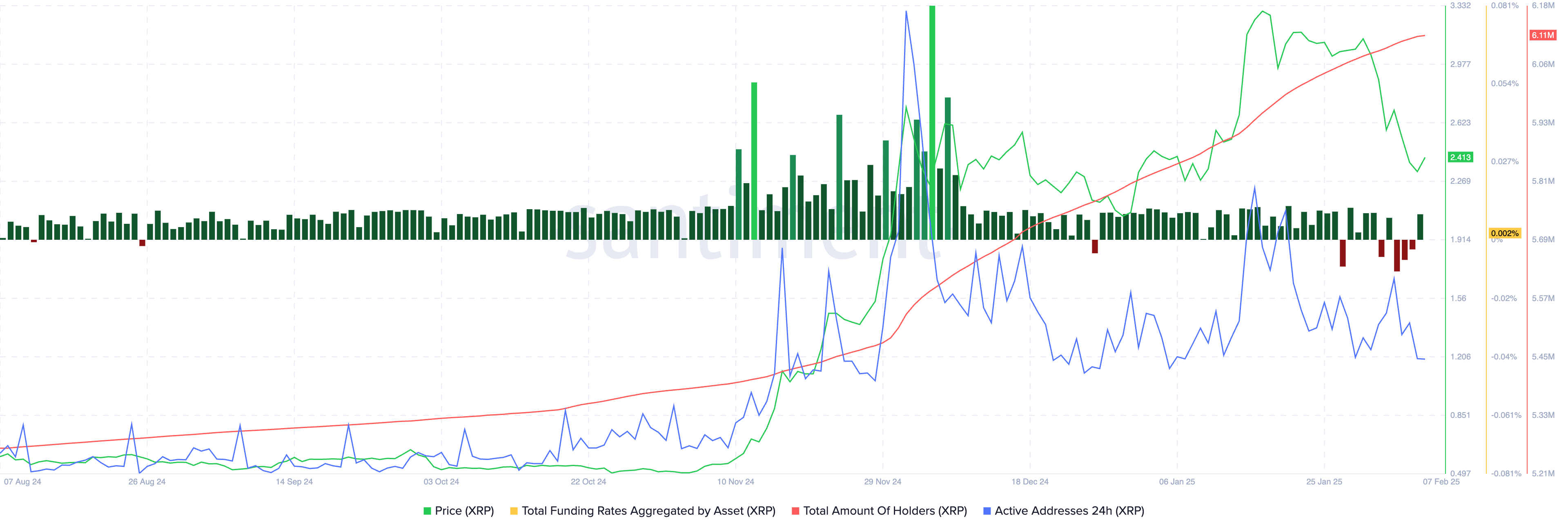

Ripple’s on-chain metrics support bullish thesis

On-chain metrics for Ripple’s XRPLedger present a recovery opportunity in the coming week. Notably, funding rates had shifted to a positive trajectory after several days of negative sentiment, suggesting renewed confidence among traders. Further supporting this bullish outlook, active addresses have surged, with total XRP holders steadily increasing through late 2024 into 2025.

The total value of assets locked on the XRPLedger remains robust, holding steady above $80 million, indicating strong investor confidence. This strong total value locked (TVL) metric contributes positively to XRP’s bullish narrative.

Technical analysis and XRP price target

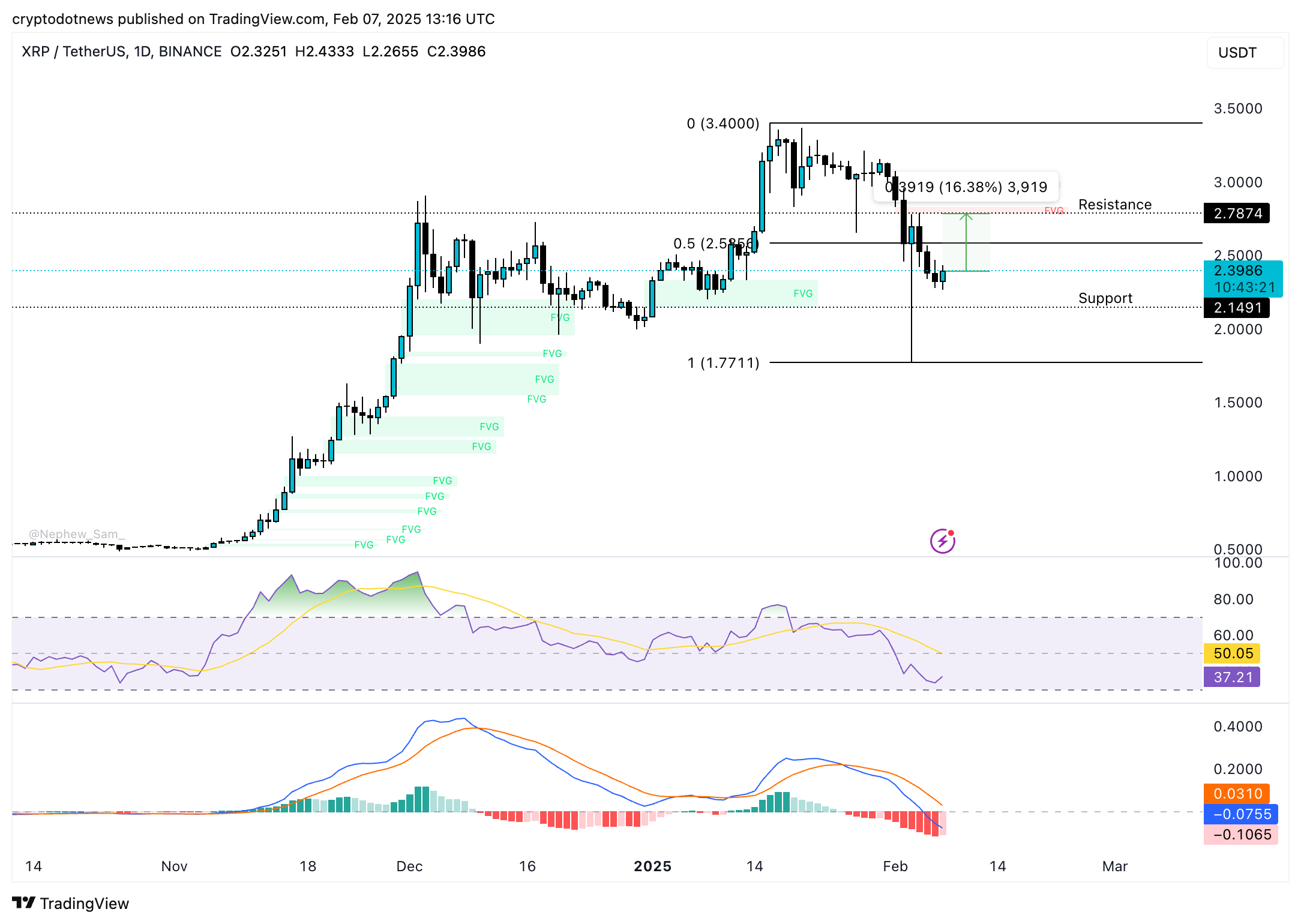

XRP has been on a downward trend since mid-January, currently trading at $2.3986. The Relative Strength Index (RSI) on the daily timeframe shows a potential for upward movement, reading at 37 and trending upward as well. The Moving Average Convergence Divergence (MACD), while hinting at negative momentum, shows diminishing histogram bars, indicating a potential for reversal soon.

XRP’s technical analysis points to a potential resistance zone between $2.7874 and $2.8281, representing a possible 16% rally if the altcoin gains momentum. On the downside, the support level has been noted at $2.1491, reflecting the high on December 31, which could act as a price cushion.

XRP Bitcoin correlation and strategic consideration

The three-month correlation between XRP and Bitcoin currently stands at 0.83, indicating a strong intrinsic relationship; when Bitcoin experiences volatility, XRP’s price movements tend to align closely with it. Therefore, traders should be vigilant and closely monitor Bitcoin’s price trends as they could influence XRP’s price actions.

Tracking the dynamics of the long/short ratio, it currently exceeds 1 on major trading platforms such as Binance and OKX, suggesting a predominantly bullish sentiment among derivatives traders. Additionally, the options open interest reflects no substantial shifts, maintaining above $3.6 billion, as noted in recent analyses.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.