The Current Landscape for Bitcoin, Hedera, and DogWifHat: A Deep Dive

Introduction to Key Players

As the cryptocurrency market navigates turbulent waters, Bitcoin (BTC), Hedera (HBAR), and DogWifHat (WIF) find themselves at critical junctures this week. Bitcoin’s recent slip below the intriguing $94,000 mark has left many investors jittery, while Hedera appears poised for a potential breakout, and DogWifHat teeters on the edge of support at $1.50. Let’s take a closer look at these developments and the implications for each of these cryptocurrencies.

Bitcoin’s Rollercoaster: Stalling at $100K

Bitcoin had a thrilling ride earlier this week, scaling above $100,000 before succumbing to heavy selling pressure, ultimately dropping to around $92,500. This dramatic decline has sent shockwaves through the market, shaking the confidence of many traders. Central to this bearish sentiment is the looming sale of 69,370 BTC by the United States Department of Justice (DOJ). This haul, amounting to $6.4 billion, originated from a historic Silk Road-related hack and was authorized for sale following a court ruling.

Market analyst Axel Adler has pointed to key demand zones between $86,800 and $89,700 as potential accumulation areas for short-term holders. Should buying pressure return in this zone, it could mark a crucial turnaround point for Bitcoin.

As Bitcoin retraces from its December 2024 all-time high of $108,000, traders remain cautious. The looming DOJ sale may disrupt pro-crypto policies proposed by President-elect Donald Trump and create further downward pressure. Notably, Bitcoin ETFs have experienced significant outflows, indicating waning institutional interest, aligning with Binance’s sharply declining stablecoin reserves.

For Bitcoin to mount a recovery, it must reclaim the $95,000 level. If not, it faces the grim possibility of probing deeper support levels around $86,000.

Hedera: Gearing Up for a Possible Breakout

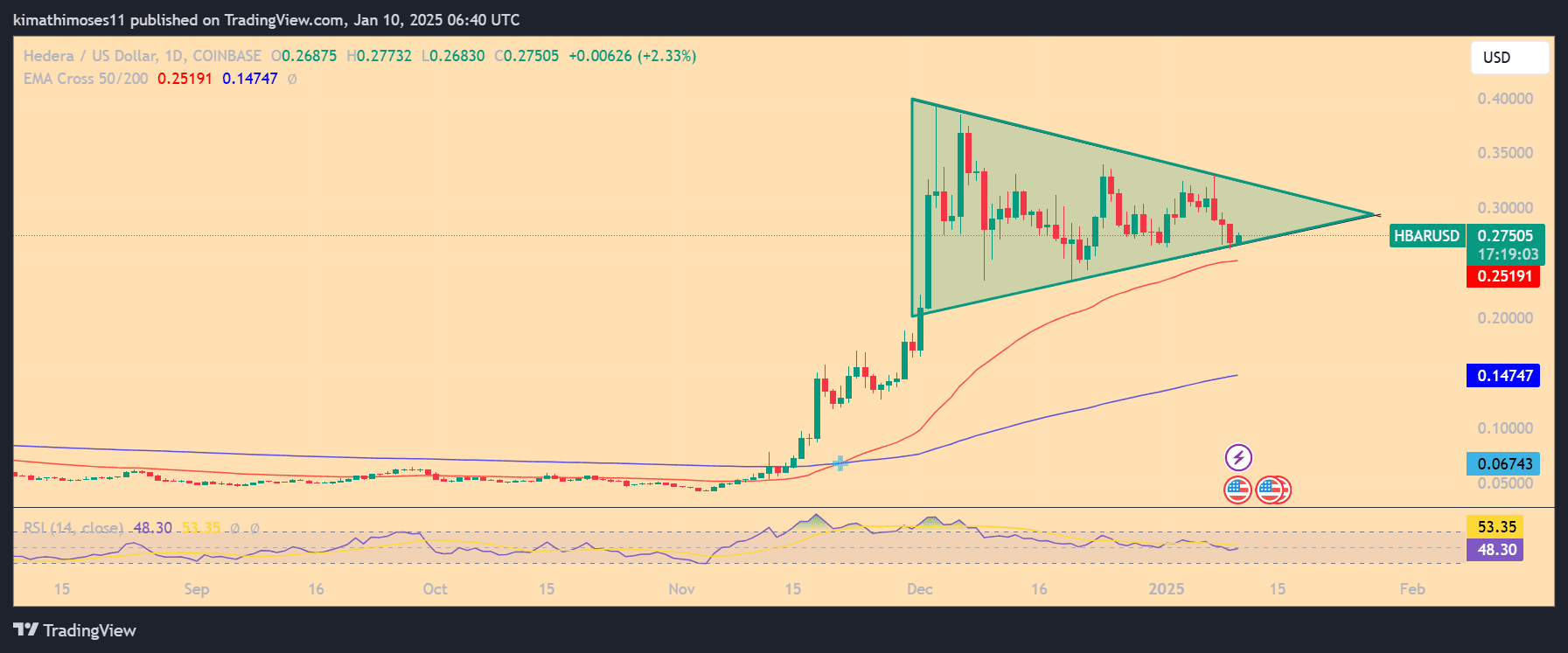

In stark contrast, Hedera (HBAR) finds itself in a consolidation phase, oscillating between $0.25 and $0.33. The formation of a symmetrical triangle indicates that traders should remain on high alert for a potential breakout in either direction. The current support level near the 50-day EMA at $0.25 is particularly crucial; a decline below this threshold may lead HBAR toward $0.20, intensifying selling pressure.

Should HBAR break through the upper boundary near $0.30, it could trigger a bullish rally targeting $0.33 or higher. With a Relative Strength Index (RSI) of 53.35, momentum appears neutral, suggesting that significant moves could be on the horizon.

Furthermore, HBAR’s recent partnerships with tech giants like NVIDIA and Intel have injected renewed interest in the platform, particularly as it aims to play a role in AI governance solutions. These developments highlight the cryptocurrency’s potential amidst broader market uncertainties.

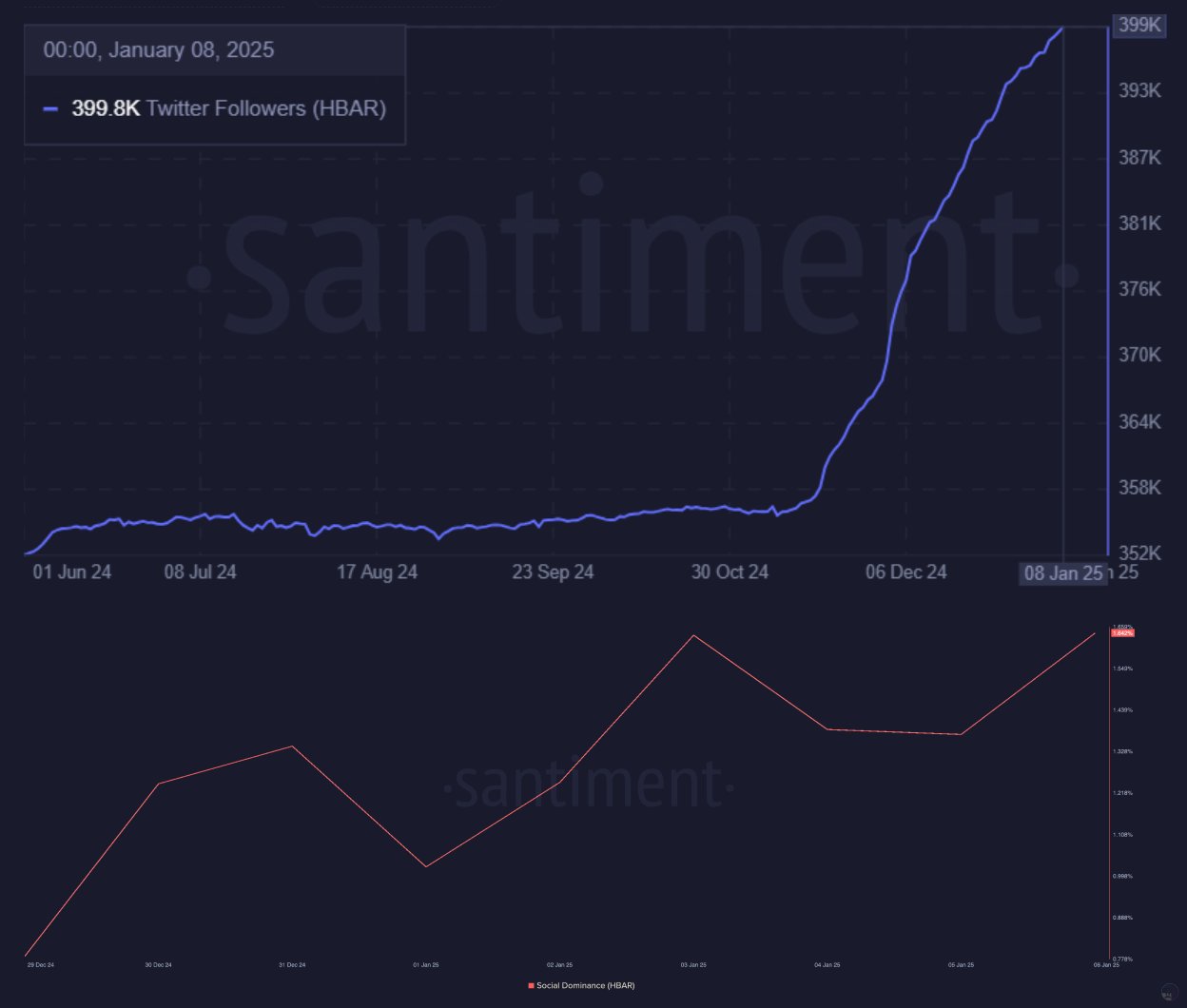

The social metrics surrounding HBAR are also worth noting, with a surge of 50,000 followers in just 60 days on Twitter, showcasing a burgeoning community interest—an essential component in the growth of any cryptocurrency.

DogWifHat: The Pressure Mounts at $1.50

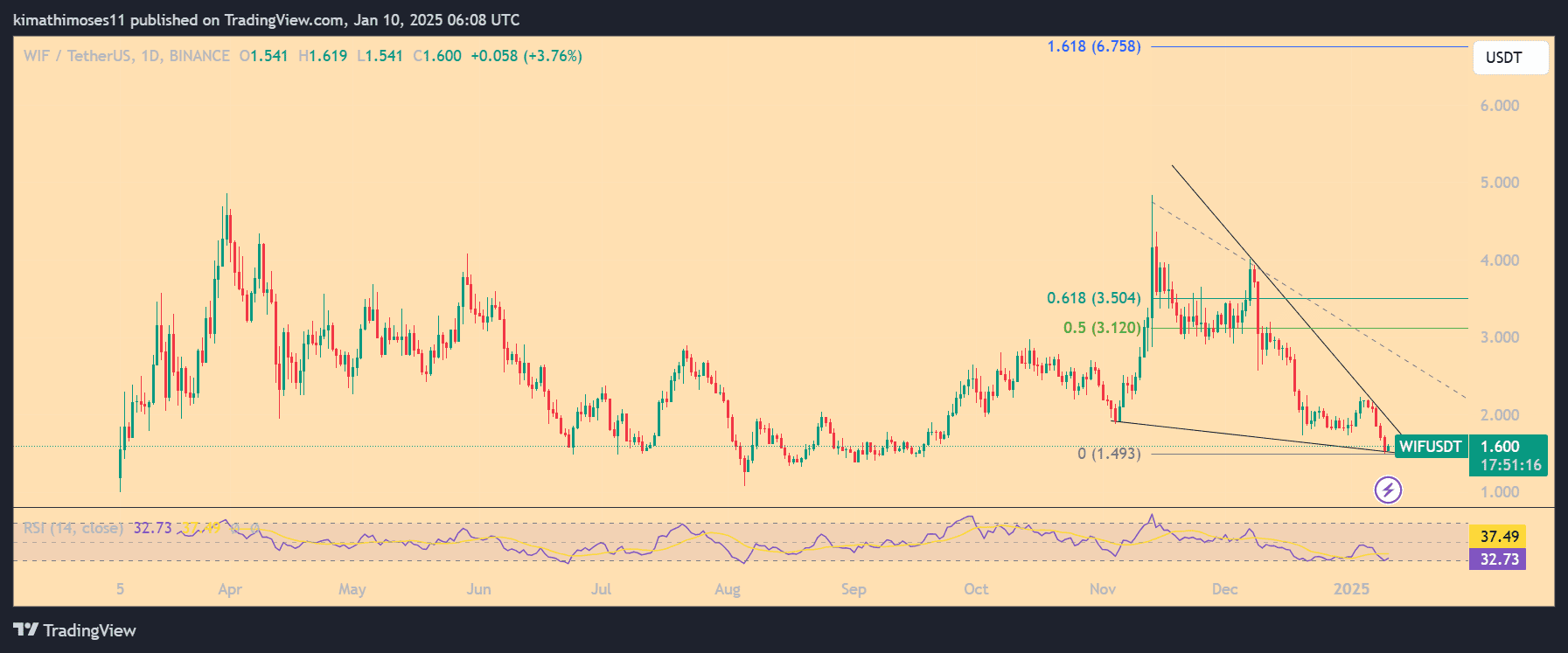

Turning to DogWifHat (WIF), this meme coin is navigating a critical juncture after a sharp decline from its $3 peak, dropping to around $1.60. The asset is currently grappling with bearish sentiment, illustrated by a double-top formation and a descending trendline, while testing the 0.786 Fibonacci retracement level at $1.50.

With the RSI currently hovering at 37.49, WIF is in oversold territory, which might attract buyers looking for a bargain. Analyst predictions highlight $1.50 as a key re-entry point; however, a breakdown here could lead to a plunge towards $1.25, increasing negative momentum.

On the upside, reclaiming the $2.44 mark, identified as the 0.5 Fibonacci level, could catalyze a rally toward $3.50, offering a glimmer of hope for WIF holders.

Navigating the Trends: The Influence of Bitcoin

The broader market landscape remains variable, with Bitcoin’s support levels likely shaping the movements of HBAR and WIF. HBAR’s potential breakout is closely aligned with Bitcoin’s performance, showcasing its dependency on the leading cryptocurrency. Similarly, WIF’s speculative nature makes it highly sensitive to overall market sentiment, particularly fluctuations in Bitcoin’s price.

In summary, Bitcoin, Hedera, and DogWifHat are all navigating challenges and opportunities that could define their trajectories in the days ahead. With critical support levels and possible breakout points emerging, traders must remain vigilant and responsive to these dynamic shifts in the cryptocurrency landscape.