The recent turbulence in global markets has sent shockwaves through the cryptocurrency ecosystem. Bitcoin, Ethereum, and XRP are facing severe corrections, driven by evolving fiscal policies under former President Trump’s administration. As of Wednesday, the total market capitalization of cryptocurrencies has plummeted to $2.784 trillion.

Bitcoin’s correlation with the S&P 500 stands at a striking 0.75 over the past month, indicating that the leading cryptocurrency is mirroring movements in U.S. equities. This alignment can often spell trouble for traders, as shifts induced by “Trumpism”—a term used here to describe the unpredictable and often combative nature of Trump’s policies—have instigated sharp declines in crypto valuations, particularly noticeable during the first fifty days of his administration.

Why is crypto losing while Trumpism wins?

The broader U.S. stock market is currently in a state of distress, with the S&P 500 dipping nearly 8% over the last month. This downturn has wiped out $4.5 trillion in market capital, and the impact has permeated into the crypto sphere. Traditionally viewed as a high-volatility asset class, cryptocurrencies are encountering a withdrawal of risk appetite among investors, prompting significant capital flight.

Interestingly, though, crypto market capitalization remains about 20% above pre-election levels despite the recent downturn. This resilience suggests a complex narrative; while traders are becoming increasingly risk-averse, the crypto sector holds potential for growth under the right conditions.

When Bitcoin hit an all-time high of $100,000, it dragged Ethereum and XRP along with it. However, the current market bleed has seen these three major cryptocurrencies face declines of approximately 15%, 28%, and 9%, respectively. Despite Trump’s pro-crypto executive initiatives and the announcement of a Strategic Crypto Reserve, the sentiment among traders remains deeply negative. The Crypto Fear & Greed Index reflects this distress, signaling overwhelming fear within the market.

According to a report by Forbes, the ramifications of Trump’s renewed presidency on alternative investments, including cryptocurrencies, hinge on the intricacies of his policy implementation and market dynamics. Traders are thus encouraged to dynamically adjust their strategies and portfolios, staying vigilant to potential regulatory changes affecting various tokens.

Crypto market crash, pre and post-election performance of Bitcoin, Ethereum, XRP

This week marks a continuation of the ongoing decline in the crypto market, following a month-long period of corrections. Amid further tariff disputes and executive actions, investor sentiment has sharply turned risk-averse, leading to a noticeable increase in realized losses for Bitcoin. The current situation signifies Bitcoin’s pivotal moment, as its performance could sway toward recovery if financial easing occurs or we could see further declines amid geopolitical friction.

The conversation surrounding the envisaged Strategic Crypto Reserve continues to ignite debate within the crypto community. Questions linger about how it would measure up against the expectations of the ecosystem, particularly regarding potential inclusions of Ethereum, XRP, Solana, and Cardano.

As traders seek clarity, historical patterns in Bitcoin pricing show typical drops of 20% to 25% before resuming their upward trajectory in a bull market. Yet, the existing geopolitical instability and the multitude of influential market actors complicate predictions for Bitcoin’s immediate future.

The $80,000 threshold now represents a critical support level for Bitcoin, with a bounce back to $100,000 potentially signaling another bullish rally. However, any slip below this support could see Bitcoin trading under the $70,000 mark, erasing significant post-election gains.

Ethereum has not fared well, currently trading approximately 30% below its pre-election level, reflecting performance reminiscent of late 2023. Multiple factors—including a lack of institutional interest, instability within the Ethereum Foundation, and liquidation of significant whale holdings—have all contributed to Ethereum’s struggles. Now priced at around $1,846, traders are hopeful for a catalyst, such as SEC approval for staking inclusion in Ether ETFs, which could bolster prices.

XRP, on the other hand, has shown remarkable resilience, currently trading approximately 75% above its pre-election levels at about $2.1668. Influential factors driving XRP price included its anticipated inclusion in the Strategic Crypto Reserve and its executive’s recent participation in Trump’s Crypto Summit, alongside shifting perspectives from the SEC regarding litigation against crypto entities.

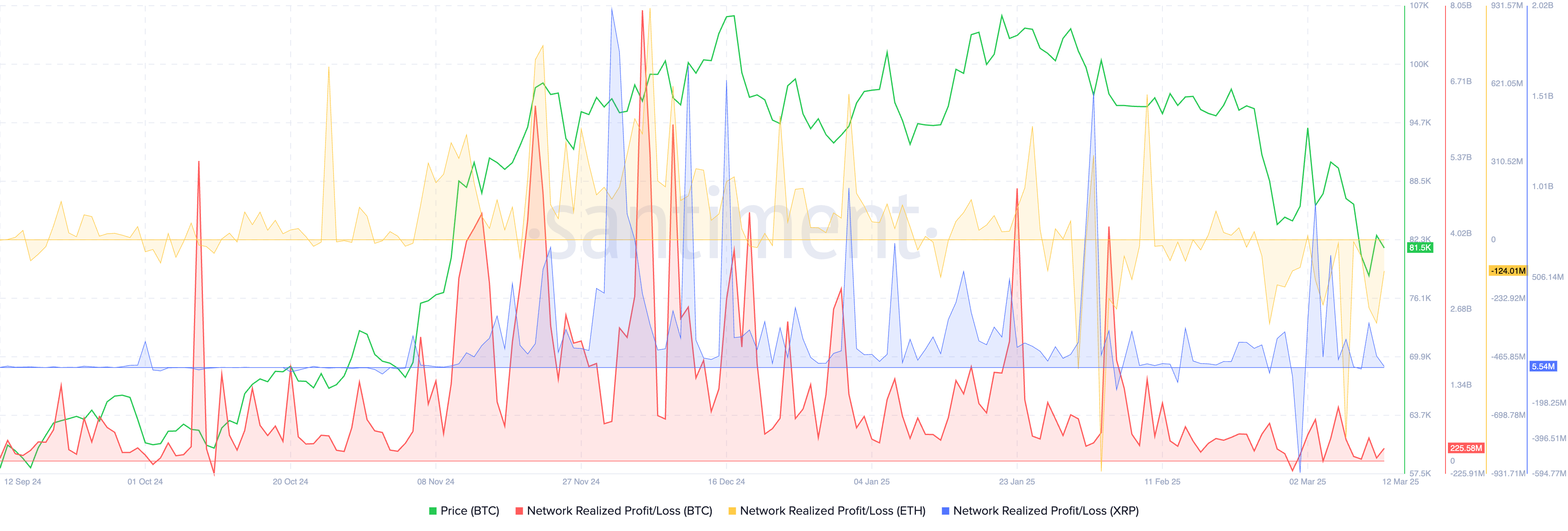

Bitcoin, Ethereum, and XRP on-chain analysis

On-chain analytics for Bitcoin show that traders have been routinely realizing profits since mid-February. In contrast, Ethereum traders are experiencing a sense of capitulation, exacerbated by significant losses realized on their holdings—an indication, analyzed through Santiment’s metrics, of growing trader distress.

Capitulation often precedes a period of stabilization in asset prices, though it remains unclear whether Ethereum can rebound effectively in the following months.

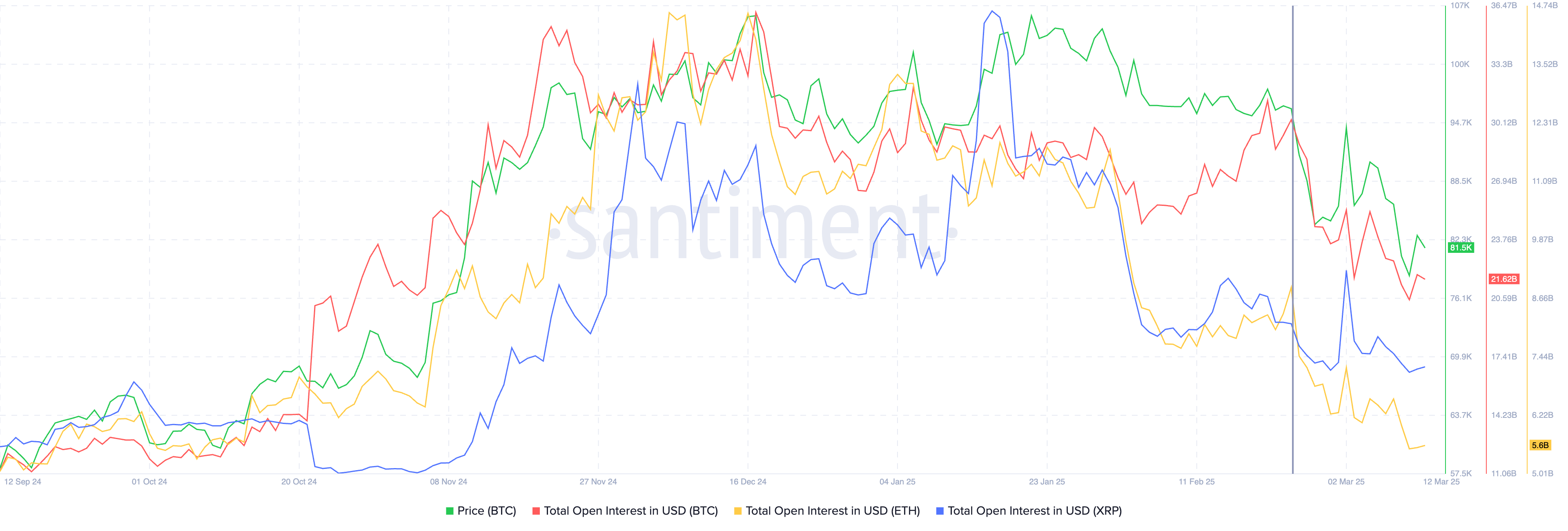

The total open interest for futures involving the major three cryptocurrencies has steadily declined since late February, underscoring the diminishing interest among derivatives traders, which correlates with the existing risk-off sentiment prevalent across global markets. As Bitcoin increasingly mirrors the behavior of tech stocks, the previously held narrative of Bitcoin as a hedge or safe haven asset is losing its footing.

Is it the end of the Bitcoin bull run?

A key crypto analyst on social media recently suggested that the steepest declines of the ongoing correction may soon be behind us. He believes that the Bitcoin bull run is far from over, bolstered by a few supporting points.

Thinking we've seen the worst of this #btc multi-month correction:

1] Multi-year diagonal support coming through

2] 0.38 fib retracement repeat

3] 0.5 fib retracement and resistance come support

4] Time fib through to end of April

5] one year moving average coming through pic.twitter.com/85XcPoAczW— dave the wave

(@davthewave) March 10, 2025

Historical patterns reveal that Bitcoin’s average corrections during previous bull markets ranged from 24% to 32%. With recent declines falling squarely within this trajectory, there is reason to believe the current fluctuations do not signal the end of the bull market.

The Crypto Bitcoin Bull Run Index, utilizing various metrics to gauge market cycles, indicates that previous peaks materialized only after crossing certain thresholds of market sentiment. The fact that the index hasn’t yet reached similar highs in this cycle suggests that there’s still potential for Bitcoin to reach new all-time values as 2025 progresses.

Market analysts have commented on the current volatility of Bitcoin, attributing it to shifting global macroeconomic factors. According to Agne Linge, Head of Growth at WeFi, the recent fluctuation between $79,000 and $85,000 is a reflection of apprehensive market sentiment, particularly concerning new tariffs expected to be introduced.

Heightened tensions between the U.S. and allies have pushed investors toward securing their capital, leading to increased demand for stable assets like U.S. Treasuries. Simultaneously, other macroeconomic developments, such as military financing in Germany, are further contributing to the instability in the traditional finance system.

Analysts at Bitfinex pointed out that prevalent market capitulation usually aligns with forthcoming stabilization, though the overarching concerns from geopolitical contexts remain formidable challenges.

Dr. Sean Dawson, Head of Research at Derive.xyz, highlighted grim prospects as macroeconomic factors worsen, revealing that bearish sentiment is growing, pushing traders towards protective hedging, particularly as marketplace volatility escalates.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.