Ethereum’s Long-Term Bullish Outlook: Key Support Sparks Reversal Prospects

By Roy Levine

Sunday, May 4, 2025

Read Time: 2 minutes

Quick Overview

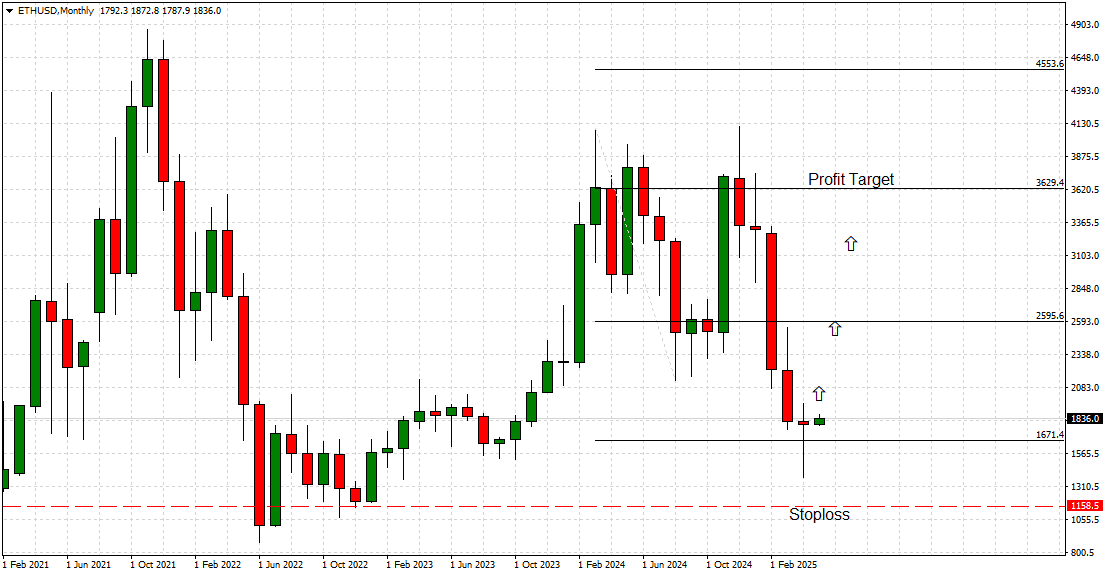

- Current Support Level: Ethereum (ETH) shows signs of bottoming out with strong support at $1671, likely indicating a bullish reversal.

- Price Action: A small green candle has emerged after a bearish phase, signifying early accumulation by strategic investors.

- Price Targets: Immediate upside targets include $2595 and $3629, with a recommended stop-loss set below $1158 for risk management.

- Transition to Proof of Stake: The network’s shift to Proof of Stake has significantly boosted scalability and security, reinforcing investor trust.

Ethereum (ETH) has been making headlines recently for its ability to recover from bearish trends, displaying robust signs of bottoming out at a critical support level of $1671. This support acted as a lifeline, drawing attention to a potential bullish reversal in the making.

The monthly chart captures the ongoing market dynamics, where a small green candle has emerged following an extended bearish phase. This technical movement indicates that smart money is beginning to accumulate ETH at or near the support level—a promising sign for traders watching for a potential upswing.

Technical Analysis: Major Support Activated

A deep dive into Ethereum’s recent price history reveals a tumultuous journey characterized by significant volatility since reaching historical highs. Notably, the $1671 support level has proven to be a critical threshold for the market. As traders observed recent price action, the market respected this level, leading to the formation of a notable rebound candle—an indication of early accumulation activities among savvy investors.

According to the Cross-Price Matrix (CPM) pivot system, the $1671 support area serves as a long-term pivot zone, drastically increasing the chances of a sustained upward correction. Should momentum persist, immediate upside targets are projected at $2595, marking a prior significant resistance level from early 2024. Should the price break through this point, traders could set their sights on an ambitious bullish target of $3629, coinciding with late 2024 highs.

For risk management, traders are advised to implement a stop-loss below $1158, allowing enough room to manage unexpected market fluctuations while safeguarding capital.

Ethereum Technology & Vision: The Road Ahead

Ethereum continues to dominate the smart contract and decentralized finance (DeFi) landscape. With its successful transition to Proof of Stake (PoS) as part of the Ethereum 2.0 upgrade, the network has drastically reduced its carbon footprint while enhancing scalability, security, and transaction finality.

This transition is pivotal not merely for environmental sustainability but also for positioning Ethereum as a go-to platform for a diverse range of applications—spanning art, gaming, supply chains, and even potential future functionalities such as national digital currencies (CBDCs). This broad vision underlines long-term investor confidence, suggesting significant strategic opportunities during market pullbacks into major support zones.

Monitoring the Market

Ethereum’s current technical structure hints that a solid long-term bottom may be forming around $1671. The alignment of positive price action with the signals from the CPM pivot system enhances the bullish sentiment surrounding Ethereum’s prospects. Traders and investors are advised to monitor the $2595 resistance level closely, as a breakout above this threshold would serve as an early confirmation of bullish momentum, with a further focus on the longer-term target at $3629.

With the market dynamics shifting and Ethereum showcasing resilience during turbulent times, all eyes are on the evolving narrative—holding potential for significant gains.