A Glimpse into Cardano’s (ADA) Bullish Potential as Weekend Approaches

As the weekend nears, the cryptocurrency market is signaling signs of recovery, and one token that has caught the eye of traders and investors alike is ADA, the native cryptocurrency of the Cardano blockchain. With recent patterns hinting at an upward surge, ADA is positioned to make significant gains in the coming days, creating a buzz in the crypto community.

Cardano (ADA) Technical Analysis and Upcoming Levels

In recent technical assessments, ADA has formed a bullish inverted head and shoulders pattern, a configuration that often suggests a potential breakout. According to analysts, if ADA manages to breach the neckline of this pattern and closes a four-hour candle above the $0.76 mark, we could be in for an exciting ride. Such a breakout may see ADA surge by as much as 10%, targeting an initial goal of $0.85 in the near future.

Source: Trading View

However, traders should exercise caution as ADA could encounter resistance near the 200 Exponential Moving Average (EMA), which currently suggests that the asset is in a downtrend. The bullish scenario hinges on ADA successfully clearing the $0.76 level; failing to do so may derail this optimistic outlook.

Zooming out to a broader timeframe, ADA appears to be consolidating within a narrow range between $0.73 and $0.757 over the past five trading days, indicating a time of buildup and anticipation. A successful break from this consolidation, particularly with a daily candle closing above $0.76, could drive ADA’s value significantly higher—potentially by up to 50%, aiming for a price of $1.15 in the not-so-distant future.

Source: Trading View

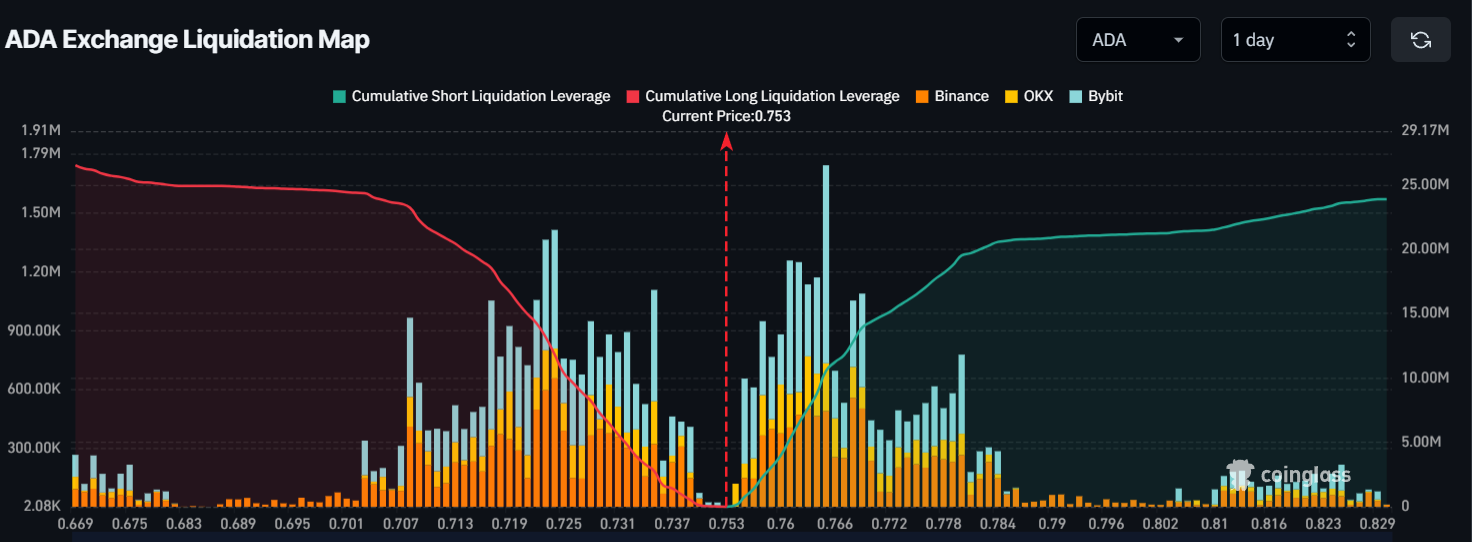

Major Liquidation Levels

On an analytical front, both bulls and bears are currently strong contenders for ADA, with recent data from the on-chain analytics firm Coinglass revealing intriguing insights. Traders are reportedly over-leveraged at a lower support level of approximately $0.723, where a hefty $12 million in long positions has been documented.

Source: Coinglass

Additionally, another significant liquidation level can be observed at around $0.765, where traders hold $10.5 million worth of ADA tokens. These liquidation levels are crucial as they reflect the sentiment and positions of traders within the market, and they can act as significant pivot points for ADA’s price action.

Overview of Market Sentiment

The current market conditions also indicate an enthusiastic atmosphere among ADA traders. With a recovering cryptocurrency market, the sentiment appears to be positively weighted towards the possibility of a bullish breakout. Investors are keenly watching how ADA interacts with the identified support and resistance levels, as these developments will play a vital role in shaping the upcoming price trajectory.

With the weekend approaching, the stages are set for Cardano’s ADA to either validate the bullish expectations or face challenges that could hinder its progress. Each movement in the price will undoubtedly be accompanied by reactions from an eager trading community, all hoping to seize the moment as the market unfolds.

In a realm marked by volatility, ADA is proving to be a focal point for many investors and enthusiasts. The upcoming days will be critical, and how the asset responds to the technical indicators and market sentiment will be pivotal for its future direction. Whether you’re a seasoned crypto trader or new to the scene, keeping a close eye on ADA will be essential as it navigates through these challenge and opportunity-laden waters.