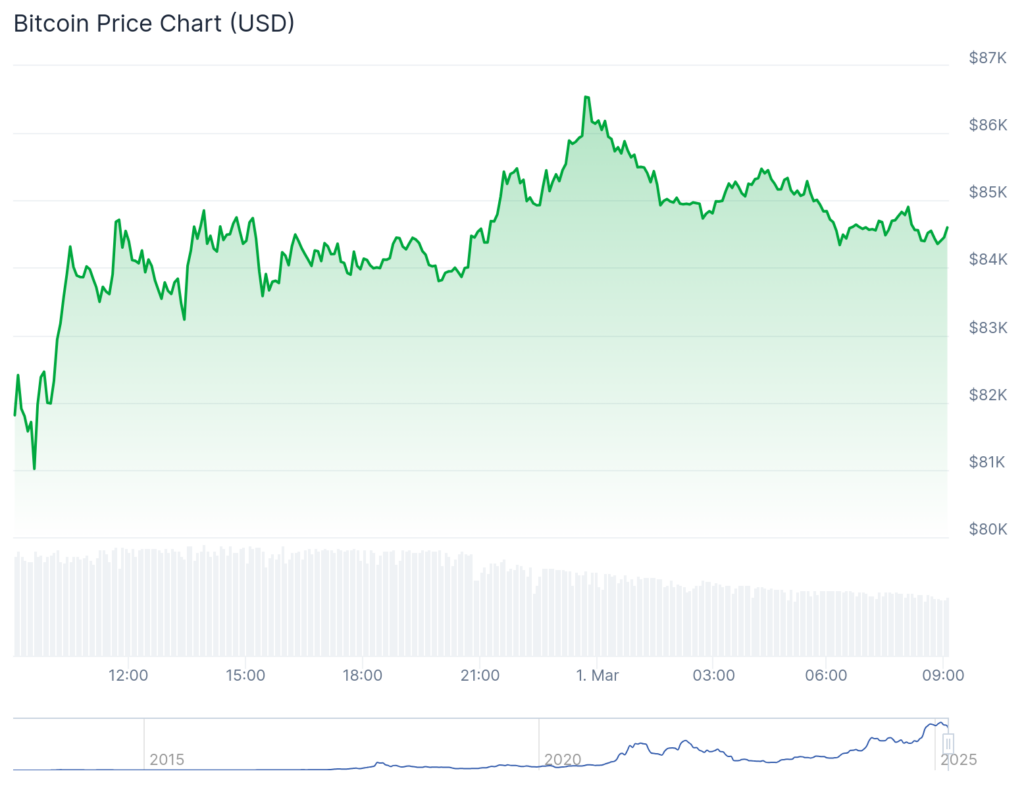

Cryptocurrency prices stabilized on the first day of the month after crashing by double digits on Friday, ahead of Bitcoin’s options expiry.

After a tumultuous Friday that saw a significant dip in prices, the cryptocurrency market began to stabilize as the new month rolled in. This calming in the crypto landscape marked a welcome shift for investors, particularly as Bitcoin (BTC) managed to bounce back above the $85,000 mark, recovering from a Friday low that plummeted to $78,115. The quick recovery of Bitcoin came on the heels of a massive options expiry worth over $5 billion, signaling to many a return of equilibrium in the market.

Among altcoins, Hedera Hashgraph (HBAR) took the lead, experiencing a remarkable surge of 25% on Saturday. This breakout illustrates the potential volatility and rapid price shifts present in the crypto market. Following closely, Stellar Lumens (XLM) rose by 16%, while Algorand (ALGO) and Ondo Finance (ONDO) joined the rally with increases exceeding 15%. Such price movements emphasize the interconnectedness of the cryptocurrency ecosystem, where fluctuations in Bitcoin often ripple through the altcoin space.

This strong surge among altcoins is attributed to the positive shift in market sentiment following Bitcoin’s rebound. The broader financial markets also saw an upswing, with major American equity indexes like the Dow Jones Industrial Average climbing by 600 points and the Nasdaq 100 and S&P 500 rallying by 95 and 300 points, respectively. Given the historical correlation between cryptocurrencies and U.S. stock indices, this synchronicity seems to bolster the optimism spreading across the digital currency landscape.

Despite the significant price movements on Saturday, no particular news directly linked to the surging altcoins was reported. However, ongoing developments surrounding regulatory acceptance from the Securities and Exchange Commission (SEC) may have provided an underlying sense of stability. The SEC recently dropped its lawsuits against prominent exchanges like Gemini, Coinbase, and Uniswap. Additionally, active discussions with crypto figure Justin Sun concerning settlements reflect a potential thaw in the SEC’s approach, which could foster a more favorable environment for cryptocurrency-related businesses.

Analysts are looking towards potential SEC approval of spot crypto ETFs, particularly for assets like Litecoin (LTC), Hedera, and Stellar. The anticipation that such approvals would likely lead to increased institutional inflows has sparked interest among investors and could significantly influence those assets’ prices in the coming days.

Another aspect driving these altcoin surges is the phenomenon of “buying the dip.” Investors often seize the opportunity to acquire assets at lower prices following significant downturns; consequently, many of these cryptocurrencies are now trading at their lowest levels in several months, enticing bargain hunters looking for recovery prospects.

However, caution is advised as this rebound might be part of a “dead cat bounce,” a market term for a temporary recovery amid an ongoing downtrend. This pattern, sometimes referred to as a bull trap, often serves to mislead investors before an asset potentially resumes its downward trajectory.

Hedera Hashgraph Price Analysis

From a technical perspective, Hedera Hashgraph (HBAR) has shown signs of recovery after hitting a low of $0.1807 this week, rebounding to $0.2360. The price has managed to momentarily surpass the 25-day moving average, and the upward trajectory of the percentage price oscillator lines suggests bullish momentum. Looking ahead, should HBAR maintain its upward trajectory, bulls might set their sights on the next resistance level at $0.2586, marking the 38.2% Fibonacci Retracement level and an earlier January swing low.

Algorand Price Technical Analysis

Conversely, Algorand (ALGO) appears to be facing headwinds. After recently consolidating, the price has dipped below the 50-day moving average, indicating that bearish forces remain dominant. The formation of a head and shoulders pattern, which is typically a bearish indicator, suggests a potential strong downturn, with analysts anticipating a retest of the psychological level at $0.20.

Stellar Price Forecast

Turning to Stellar (XLM), the price exhibited considerable volatility over the past few months. After peaking at $0.6360 on November 24 last year, it subsequently fell to $0.2537 on Saturday. The price has been characterized by a series of lower highs and lower lows, establishing a descending channel. Following a recent retest of the channel’s lower boundary on Friday, a small doji candle formation indicates possible bullish sentiment; thus, any rebound could see price targets aim for the upper end of the channel around $0.35.

Ondo Price Prediction

The price dynamics for Ondo Finance (ONDO) reflect a bearish trend as well. Although ONDO peaked at $2.1590 in December, it has since fallen to around the psychological threshold of $1. The price has also dropped below both the 50-day moving average and the 61.8% Fibonacci Retracement level. Like Algorand, the presence of a head and shoulders pattern suggests potential further downside risk, with analysts eyeing the critical support level at $0.80.

As the crypto market continues to navigate these complexities, Bitcoin presently trades at $84,536, reflecting an uptick of 2.7%, yet still down approximately 22.4% from its all-time high. Its current position underscores the ongoing volatility and uncertain sentiments within the broader cryptocurrency landscape.