Solana price has regained momentum and jumped for five consecutive days, reaching its highest point since December 6.

Solana (SOL) rose to a high of $245 on Saturday, marking a striking increase of 42% from its lowest point this month. This surge has pushed its market valuation to $117 billion, establishing Solana as the fifth-biggest cryptocurrency, trailing only Bitcoin, Ethereum, Ripple, and Tether.

Let’s delve into some of the major factors driving SOL’s recent rally, along with insights that suggest this upward trend may continue in the near future.

Solana’s Ecosystem Growth

The primary catalyst behind Solana’s price spike is the robust growth of its ecosystem. This includes a remarkable rise in meme coins, which have collectively amassed over $22 billion in market capitalization. Notably, the newly launched Official Trump coin (TRUMP), unveiled by President-elect Donald Trump on January 17, has already reached a valuation of $4.4 billion.

In addition to TRUMP, other popular meme coins within the Solana ecosystem, like Bonk (BONK), Dogwifhat (WIF), and Pudgy Penguins (PENGU), are contributing to the overall growth and visibility of Solana in the crypto space.

Solana’s prominence isn’t limited to meme coins; it also plays a significant role in the non-fungible token (NFT) market. According to CryptoSlam, Solana’s NFT transactions generated over $81 million in sales during the last 30 days, positioning it as the third-largest player in the NFT realm, trailing only behind Ethereum and Bitcoin.

The continued growth of Solana’s ecosystem can be attributed to its impressive transaction speeds, low costs, and the popularity of its decentralized exchange (DEX) networks. Recent data reveals that Solana’s DEX networks facilitated $32.2 billion in trading volume over the past week, significantly outpacing Ethereum’s $9.2 billion.

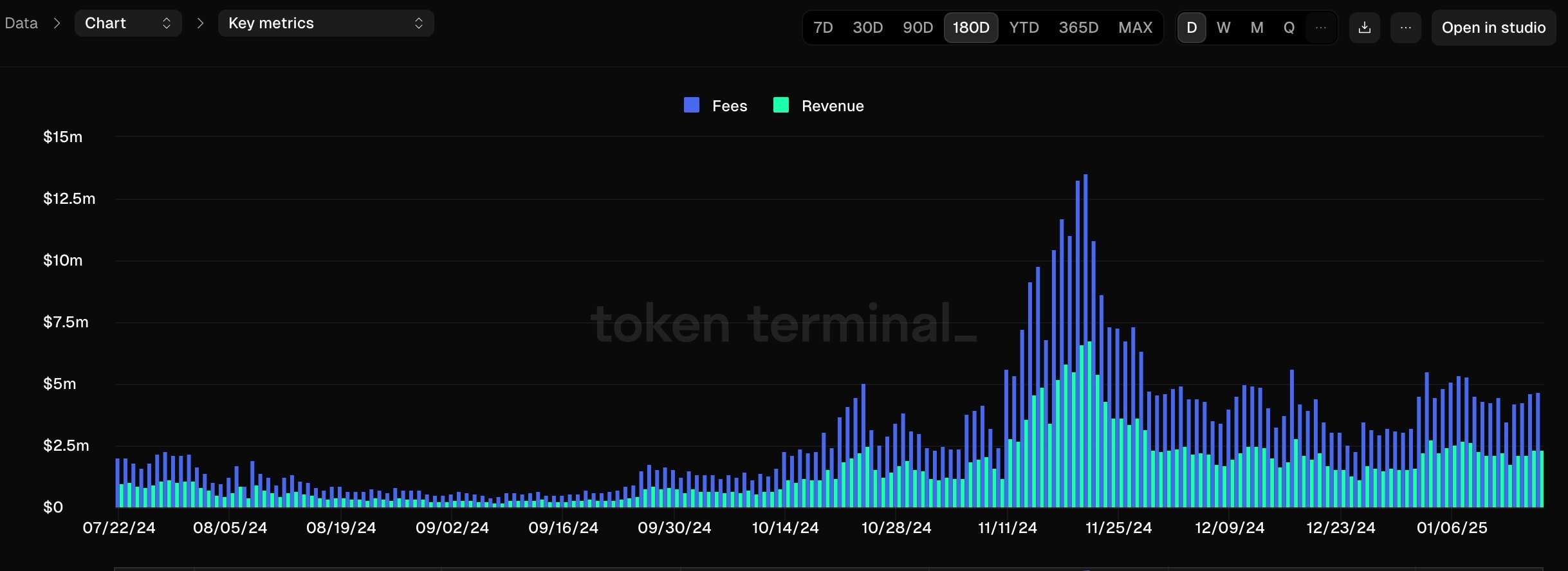

This ecosystem expansion has resulted in increased network fees, which have accumulated to a noteworthy total of $820 million over the last year and $77 million so far this year. A portion of these fees flows back to Solana stakers, who are currently enjoying a yield of around 7%.

Solana ETF Hopes Are Steady

Another driving force behind the recent price increases is the optimistic sentiment surrounding the potential approval of a Solana-based exchange-traded fund (ETF) by the Securities and Exchange Commission (SEC). Current predictions reflected in a Polymarket poll suggest a probability of 77%, indicating that the agency under the leadership of Paul Atkins may be leaning toward approval.

If a Solana ETF comes to fruition, it could significantly boost demand for the coin among institutional investors, especially if the SEC allows these digital assets to be staked. A recent note from JPMorgan suggests that a Solana ETF could attract between $3 billion and $6 billion in investment during its first year.

Solana Price Technicals Are Supportive

Technically speaking, Solana displays promising signs on the daily chart. The SOL token bounced back after establishing a double-bottom pattern at $175.42, subsequently climbing above the neckline of that pattern at $222.95, marking its peak swing on January 6.

Founded in 2020 by engineer Anatoly Yakovenko, Solana has maintained its position above an ascending trendline that has been in place since January 23 of last year. It continues to trade above the 50-day moving average, and the Relative Strength Index (RSI) is showing an upward trend, indicating bullish momentum.

Analysts believe that the Solana price is likely to maintain its upward trajectory, particularly if it surmounts the key resistance level at $264.15, which represents its highest point so far in 2024.

Solana Up Until Now

Anatoly Yakovenko’s vision for Solana was to create a blockchain capable of facilitating millions of transactions per second, effectively addressing the criticisms surrounding Ethereum’s transaction speeds and associated costs. The network is specifically engineered to support decentralized applications (dApps) and cryptocurrency transactions.

Solana prides itself on its rapid transaction processing and superior throughput compared to many rival platforms. Following the launch of its mainnet in 2020, Solana captured attention due to its speed and affordability, leading to a growing focus from developers and investors alike. Throughout 2021, the network expanded significantly, hosting a wide array of decentralized finance (DeFi) projects and NFTs.

Today, Solana’s impressive developments are backed by prominent venture capital firms such as Andreessen Horowitz, and the platform continues to evolve rapidly, offering efficient blockchain solutions in the dynamic crypto landscape.