Cryptocurrency Market Update: A Shift in Momentum

Market Overview

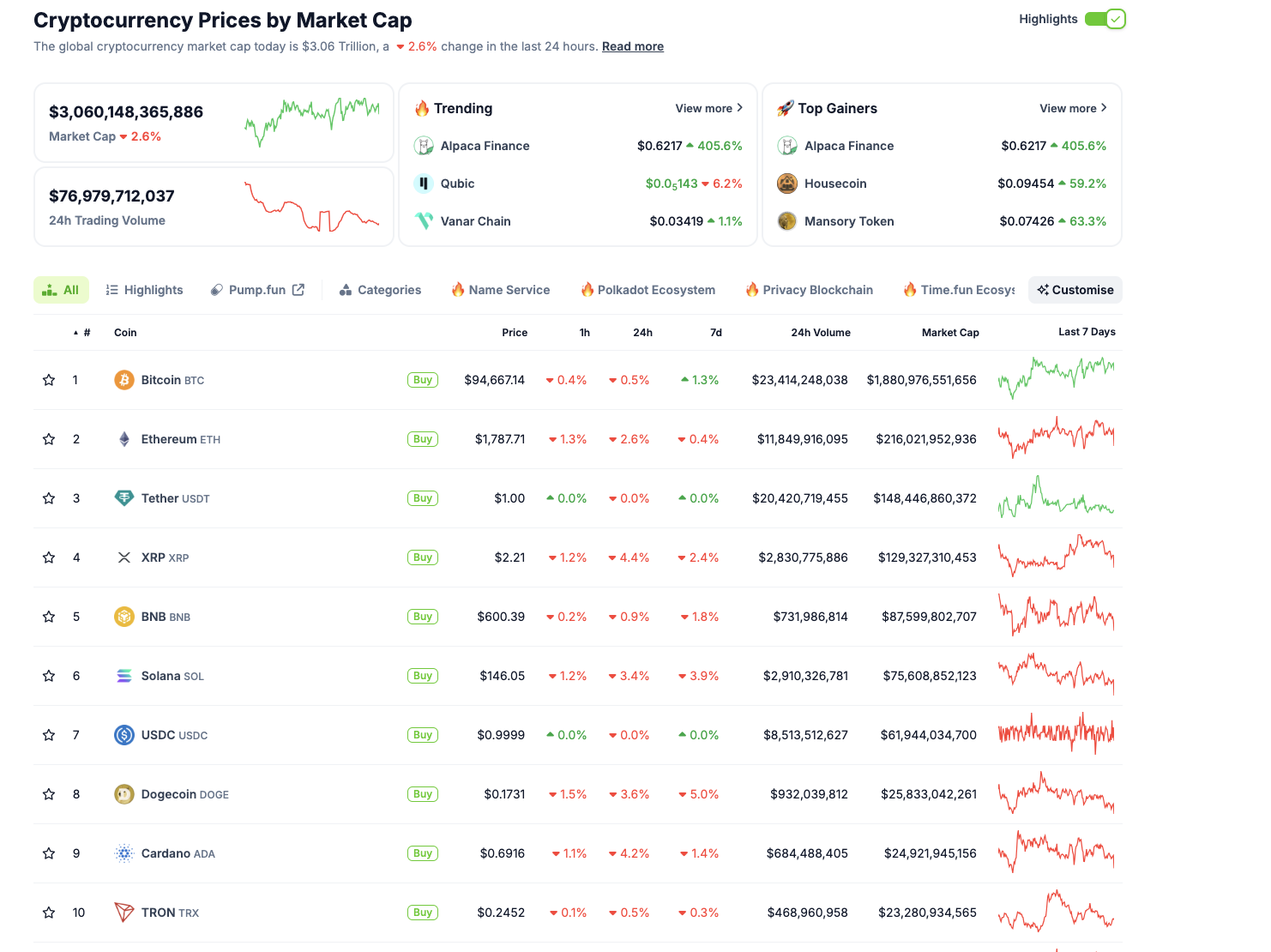

The cryptocurrency market experienced a notable decline of 2.6% on Wednesday, holding steady above the $3.06 trillion mark. This downturn was largely influenced by the recent decision from the US Securities and Exchange Commission (SEC) to postpone its verdict on altcoin exchange-traded funds (ETFs), igniting a wave of sell-offs across various altcoins.

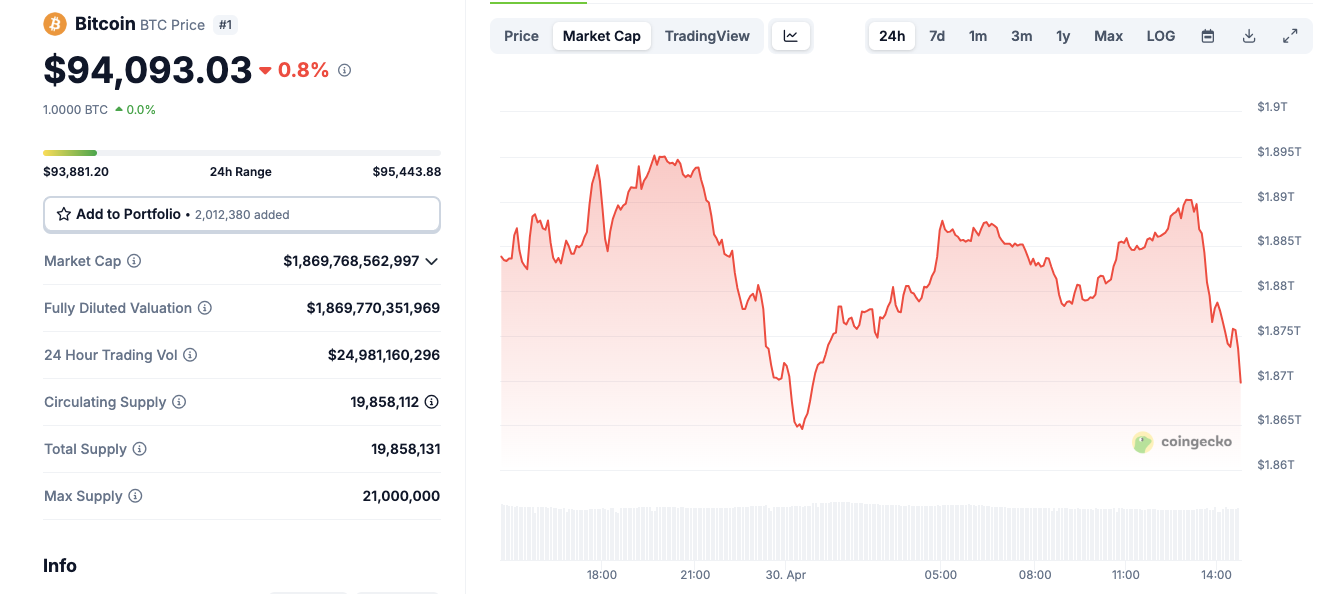

Bitcoin Price Action

Bitcoin, the leading cryptocurrency, has been tightly hovering around the resistance level of $95,500, marking its sixth consecutive day at this threshold before a slight pullback to $94,200. Trading volumes, however, are showing signs of increasing activity, indicating that despite the temporary setback, there are buyers stepping back into the market as some investors shift their focus from altcoins to Bitcoin in response to the ETF news.

Source: Coingecko

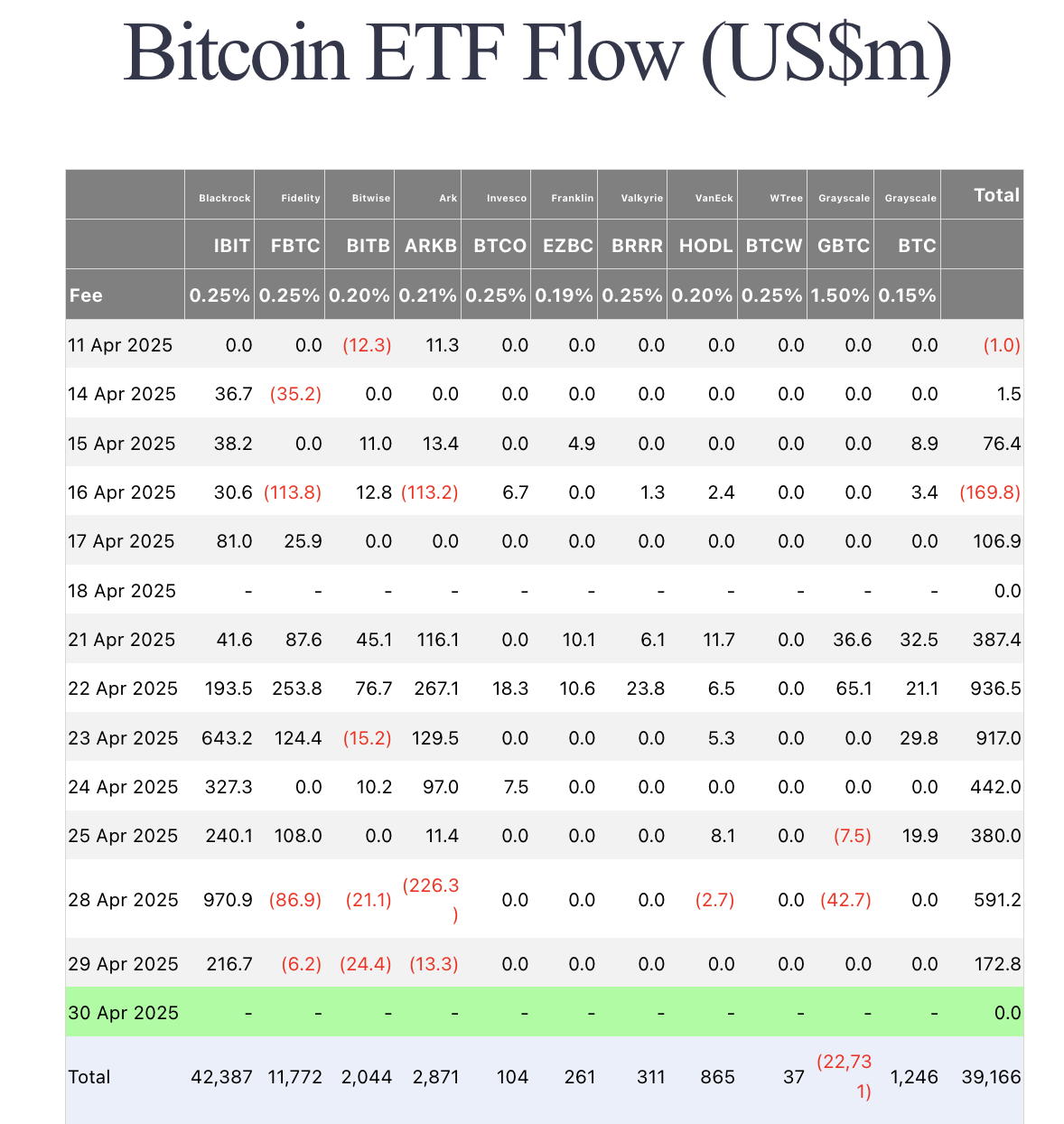

ETF Inflows Signal Institutional Interest

In a positive turn for Bitcoin, ETFs dedicated to the cryptocurrency have seen a surge in inflows, amounting to another $178 million just on Tuesday. This uptick suggests growing interest from corporate investors in Bitcoin as a means of diversification, especially amid the turbulence in equity markets linked to ongoing trade tensions. Notably, BlackRock’s ETFs accounted for a significant portion of these inflows, while other funds like Ark Invest and Fidelity reported outflows.

Source: Farside

Altcoin Market Reaction

The altcoin market has not fared as well, with major players like XRP, Dogecoin (DOGE), and Avalanche (AVAX) all experiencing declines exceeding 3% following the SEC’s decision to delay spot ETF applications. Despite the procedural nature of this delay, the market reacted nervously, resulting in a collective hit among altcoins.

XRP, after previously spiking to $2.30, found itself retracing back to $2.18, reflecting investor anxiety. DOGE mirrored this decline, dropping 3.5% over 24 hours, yet it maintained a modest weekly gain of 7%, suggesting that the impact of this news may still be unfolding. Meanwhile, Avalanche struggled to stay above $18 following a 3.9% dip.

Source: Coingecko

Broader Implications for the Market

The SEC’s ETF delays might be influencing short-term capital flows, driving investors toward Bitcoin and Ethereum, both of which have fared comparatively better, with losses kept under 3% in the past 24 hours. Bitcoin’s resilience, with its price staying above $95,000 for several days, is mirrored by Ethereum’s rise, reaching a monthly high of $1837, showcasing a shift in market dynamics.

Regulatory Updates: PayPal and Crypto Regulations

In another significant development, the SEC has decided to close its investigation into PayPal’s PYUSD stablecoin without imposing any enforcement actions. This outcome follows PayPal’s strategic partnerships aimed at bolstering PYUSD adoption, including collaborations with Coinbase to eliminate trading fees and integration into the Solana blockchain for improved efficiency.

Additionally, the recent re-election of Mark Carney as Canada’s Prime Minister casts a shadow over potential cryptocurrency regulatory advancements. Carney has historically expressed skepticism toward cryptocurrencies, leading to concerns that his administration may adopt a cautious regulatory approach, particularly following the electoral defeat of Pierre Poilievre, a prominent supporter of cryptocurrency initiatives.

The shifting landscape of cryptocurrency regulation and market dynamics continues to shape investor sentiments and trading strategies, making this an exciting yet turbulent time for the digital asset sphere.